Wood Flooring Market

| Format: PDF/PPT/Excel

| Product ID:

3823

| Report Version:

August 2025

- Report Preview

- Table of Content

- Request Customization

Market Snappshot

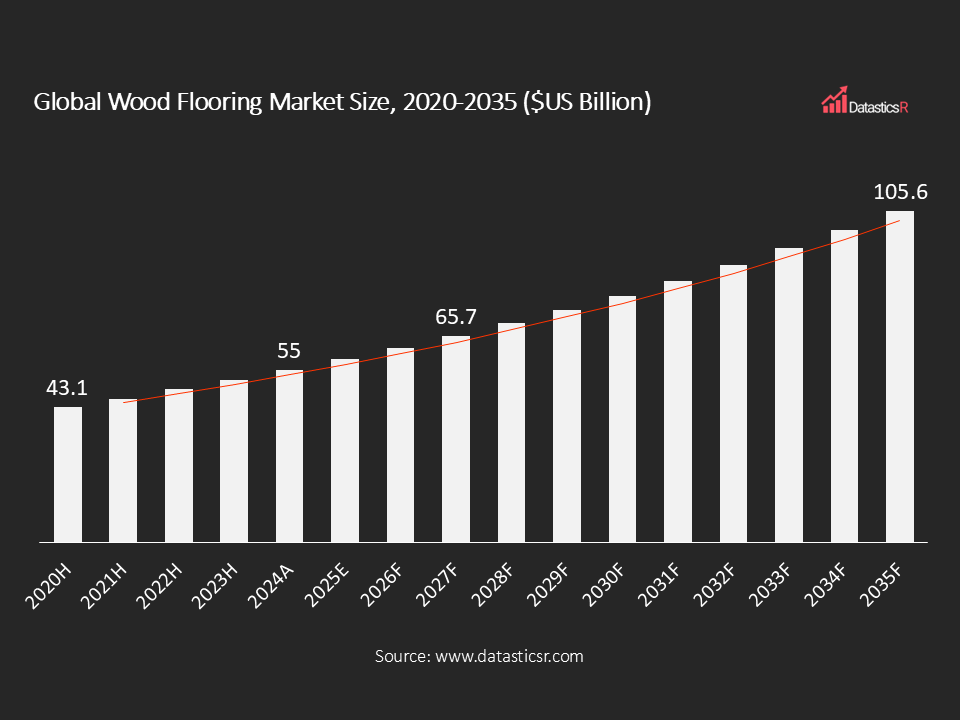

- Market Size in 2024: $US 55 Billion

- Forecast Market by 2035: $US 105.6 Billion

- CAGR for the Period 2025-2035: 6.1%

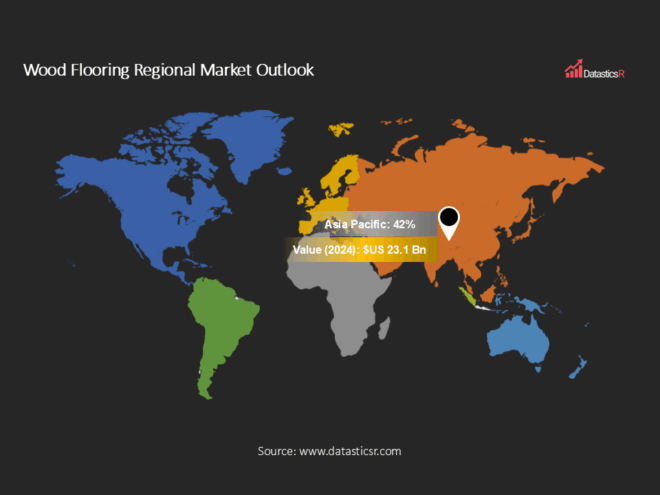

- Top Region in Terms of Market Share: Asia Pacific (42%)

- Key Players: Mohawk Industries, Shaw Floors, Armstrong Flooring, Mannington Mills, Tarkett Group, BerryAlloc, Kährs Group, Mullican Flooring, Anderson Tuftex, Mohawk, and others.

Analyst Viewpoint:

Wood Flooring Market Overview:

| Drivers | Growing Urban Housing and Home-remodeling Activity Increasing Demand for Aesthetically Driven Wood Flooring |

| Adoption and Shift to Certified Timber and Engineered Boards for Performance, Lower Waste, and Circularity |

Growing Urban Housing and Home-remodeling Activity Increasing Demand for Aesthetically Driven Wood Flooring

Adoption and Shift to Certified Timber and Engineered Boards for Performance, Lower waste, and Circularity

Wood Flooring Regional Market Outlook:

Key Companies in Wood Flooring Market:

Key Developments in Wood Flooring Market:

| 1. Bjelin Launches High-Tech Slate Collection at HD Expo: In April 2025, Bjelin launched its revolutionary Slate Collection in April 2025 with innovative Nadura Tiles boasting extreme texture and natural color variation for high-performance, Class 34-rated durability in demanding residential and commercial uses. Launched at HD Expo, the move represents a major foray into high-tech, long-lasting wood flooring solutions. |

| 2. Shaw Introduces RevWood Premier with Waterproof & Sustainable Design: In February 2025, Shaw Floors shows enter the waterproof laminate category with its new RevWood Premier line, featuring upto 75 textured layers, over 1,000 color options, and WetProtect technology. This sustainable, NALFA Platinum Level–certified collection featuring a lifetime surface and a subfloor warranty settng a new standards for sustainability and design. |

Wood Flooring Market Attributes:

| ATTRIBUTE | DETAILS |

| Market Value, 2024 | $US 55 billion |

| Forecasted Market Value, 2035 | $US 105.6 billion |

| CAGR (2025-2035) | 6.1% |

| Analysis Period | 2025-2035 |

| Historic Period | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Volume Unit | Mn Sq. Meters |

| Value Unit | $US billion |

| Market Segmentation | By Flooring Type

By Wood Type

By Thickness

By Application

By Region

|

| Companies Profiles |

|

| Customization Request | Available upon request |

1. Introduction

1.1. Report Scope

1.2. Market Segmentations and Definitions

1.3. Geographical Coverage

2. Executive Summary

2.1. Key Facts and Figures

2.2. Trends Impacting the Market

2.3. DatasticsR Growth Opportunity Matrix

3. Market Overview

3.1. Global Wood Flooring Market Analysis and Forecast, 2020-2035

3.1.1. Global Wood Flooring Market Size (Mn Sq. Meters)

3.1.2. Global Wood Flooring Market Size ($US Bn)

3.2. Supply-side and Demand-side Trends

3.3. Technology Roadmap and Developments

3.4. Market Dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Porter’s Five Forces Analysis

3.6. PESTL Analysis

3.7. Industry SWOT Analysis

3.8. Regulatory Landscape

3.9. Value Chain Analysis

3.9.1. List of Raw Material Suppliers

3.9.2. List of Manufacturers

3.9.3. List of Dealers/Distributors

3.9.4. List of Potential Customers

3.10. Impact of Current Geopolitical Scenario on the Market

4. Technical Analysis

4.1. Product Specification Analysis

4.2. Details of Thickness

4.3. Technology Adoption and Emerging Technologies

4.4. R&D Trends and Patents Landscape

4.5. Cost Structure and Profitability Analysis

5. Global Production Output Analysis (Mn Sq. Meters), by Region, 2024

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Import-export Analysis Volume (Mn Sq. Meters) and Value ($US Bn), by Key Country, 2020-2024

7. Price Trend Analysis and Forecasting ($US/Sq. Meter), 2020-2035

7.1. Price Trend Analysis and Forecasting, by Flooring Type

7.2. Price Trend Analysis and Forecasting, by Region

8. Global Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

9. Global Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

10. Global Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

11. Global Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

12. Global Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Region, 2020-2035

13. North America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

14. North America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

15. North America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

16. North America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

17. U.S. Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

18. U.S. Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

19. U.S. Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

20. U.S. Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

21. Canada Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

22. Canada Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

23. Canada Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

24. Canada Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

25. Europe Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

26. Europe Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

27. Europe Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

28. Europe Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

29. Germany Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

30. Germany Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

31. Germany Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

32. Germany Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

33. U.K. Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

34. U.K. Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

35. U.K. Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

36. U.K. Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

37. France Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

38. France Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

39. France Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

40. France Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

41. Italy Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

42. Italy Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

43. Italy Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

44. Italy Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

45. Spain Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

46. Spain Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

47. Spain Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

48. Spain Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

49. Russia & CIS Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

50. Russia & CIS Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

51. Russia & CIS Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

52. Russia & CIS Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

53. Rest of Europe Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

54. Rest of Europe Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

55. Rest of Europe Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

56. Rest of Europe Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

57. Asia Pacific Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

58. Asia Pacific Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

59. Asia Pacific Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

60. Asia Pacific Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

61. China Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

62. China Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

63. China Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

64. China Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

65. India Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

66. India Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

67. India Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

68. India Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

69. Japan Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

70. Japan Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

71. Japan Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

72. Japan Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

73. South Korea Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

74. South Korea Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

75. South Korea Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

76. South Korea Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

77. Taiwan Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

78. Taiwan Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

79. Taiwan Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Fabrication Technology, 2020-2035

80. Taiwan Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

81. Taiwan Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

82. Australia Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

83. Australia Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

84. Australia Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Fabrication Technology, 2020-2035

85. Australia Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

86. Australia Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

87. ASEAN Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

88. ASEAN Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

89. ASEAN Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

90. ASEAN Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

91. Rest of Asia Pacific Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

92. Rest of Asia Pacific Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

93. Rest of Asia Pacific Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

94. Rest of Asia Pacific Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

95. Latin America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

96. Latin America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

97. Latin America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

98. Latin America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

99. Mexico Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

100. Mexico Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

101. Mexico Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

102. Mexico Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

103. Brazil Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

104. Brazil Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

105. Brazil Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

106. Brazil Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

107. Argentina Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

108. Argentina Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

109. Argentina Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

110. Argentina Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

111. Rest of Latin America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

112. Rest of Latin America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

113. Rest of Latin America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

114. Rest of Latin America Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

115. Middle East and Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

116. Middle East and Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

117. Middle East and Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

118. Middle East and Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

119. Saudi Arabia Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

120. Saudi Arabia Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

121. Saudi Arabia Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

122. Saudi Arabia Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

123. UAE Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

124. UAE Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

125. UAE Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

126. UAE Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

127. South Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

128. South Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

129. South Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

130. South Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

131. Rest of Middle East and Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Flooring Type, 2020-2035

132. Rest of Middle East and Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Wood Type, 2020-2035

133. Rest of Middle East and Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Thickness, 2020-2035

134. Rest of Middle East and Africa Wood Flooring Market Analysis and Forecasting (Mn Sq. Meters) ($US Bn), by Application, 2020-2035

135. Competition Landscape

135.1. Market Share Analysis (%), by Company, 2024

135.2. Competitive Benchmarking

135.3. Company Profiles

135.3.1. Mohawk Industries

135.3.1.1. Company Overview

135.3.1.2. Product Portfolio

135.3.1.3. Financials

135.3.1.4. Geographical Footprint

135.3.1.5. SWOT Analysis

135.3.1.6. Recent Developments and Strategies

135.3.2. Shaw Floors

135.3.2.1. Company Overview

135.3.2.2. Product Portfolio

135.3.2.3. Financials

135.3.2.4. Geographical Footprint

135.3.2.5. SWOT Analysis

135.3.2.6. Recent Developments and Strategies

135.3.3. Armstrong Flooring

135.3.3.1. Company Overview

135.3.3.2. Product Portfolio

135.3.3.3. Financials

135.3.3.4. Geographical Footprint

135.3.3.5. SWOT Analysis

135.3.3.6. Recent Developments and Strategies

135.3.4. Mannington Mills

135.3.4.1. Company Overview

135.3.4.2. Product Portfolio

135.3.4.3. Financials

135.3.4.4. Geographical Footprint

135.3.4.5. SWOT Analysis

135.3.4.6. Recent Developments and Strategies

135.3.5. Tarkett Group

135.3.5.1. Company Overview

135.3.5.2. Product Portfolio

135.3.5.3. Financials

135.3.5.4. Geographical Footprint

135.3.5.5. SWOT Analysis

135.3.5.6. Recent Developments and Strategies

135.3.6. BerryAlloc

135.3.6.1. Company Overview

135.3.6.2. Product Portfolio

135.3.6.3. Financials

135.3.6.4. Geographical Footprint

135.3.6.5. SWOT Analysis

135.3.6.6. Recent Developments and Strategies

135.3.7. Kährs Group

135.3.7.1. Company Overview

135.3.7.2. Product Portfolio

135.3.7.3. Financials

135.3.7.4. Geographical Footprint

135.3.7.5. SWOT Analysis

135.3.7.6. Recent Developments and Strategies

135.3.8. Mullican Flooring

135.3.8.1. Company Overview

135.3.8.2. Product Portfolio

135.3.8.3. Financials

135.3.8.4. Geographical Footprint

135.3.8.5. SWOT Analysis

135.3.8.6. Recent Developments and Strategies

135.3.9. Anderson Tuftex

135.3.9.1. Company Overview

135.3.9.2. Product Portfolio

135.3.9.3. Financials

135.3.9.4. Geographical Footprint

135.3.9.5. SWOT Analysis

135.3.9.6. Recent Developments and Strategies

135.3.10. Mohawk

135.3.10.1. Company Overview

135.3.10.2. Product Portfolio

135.3.10.3. Financials

135.3.10.4. Geographical Footprint

135.3.10.5. SWOT Analysis

135.3.10.6. Recent Developments and Strategies

135.3.11. Faus Group

135.3.11.1. Company Overview

135.3.11.2. Product Portfolio

135.3.11.3. Financials

135.3.11.4. Geographical Footprint

135.3.11.5. SWOT Analysis

135.3.11.6. Recent Developments and Strategies

135.3.12. Proximity Mills

135.3.12.1. Company Overview

135.3.12.2. Product Portfolio

135.3.12.3. Financials

135.3.12.4. Geographical Footprint

135.3.12.5. SWOT Analysis

135.3.12.6. Recent Developments and Strategies

135.3.13. Doma

135.3.13.1. Company Overview

135.3.13.2. Product Portfolio

135.3.13.3. Financials

135.3.13.4. Geographical Footprint

135.3.13.5. SWOT Analysis

135.3.13.6. Recent Developments and Strategies

135.3.14. Mercier Wood Flooring

135.3.14.1. Company Overview

135.3.14.2. Product Portfolio

135.3.14.3. Financials

135.3.14.4. Geographical Footprint

135.3.14.5. SWOT Analysis

135.3.14.6. Recent Developments and Strategies

135.3.15. Mullican

135.3.15.1. Company Overview

135.3.15.2. Product Portfolio

135.3.15.3. Financials

135.3.15.4. Geographical Footprint

135.3.15.5. SWOT Analysis

135.3.15.6. Recent Developments and Strategies

135.3.16. Others

136. Appendix