Recycled Copper Market

| Format: PDF/PPT/Excel

| Product ID:

3758

| Report Version:

August 2025

- Report Preview

- Table of Content

- Request Customization

Market Snappshot

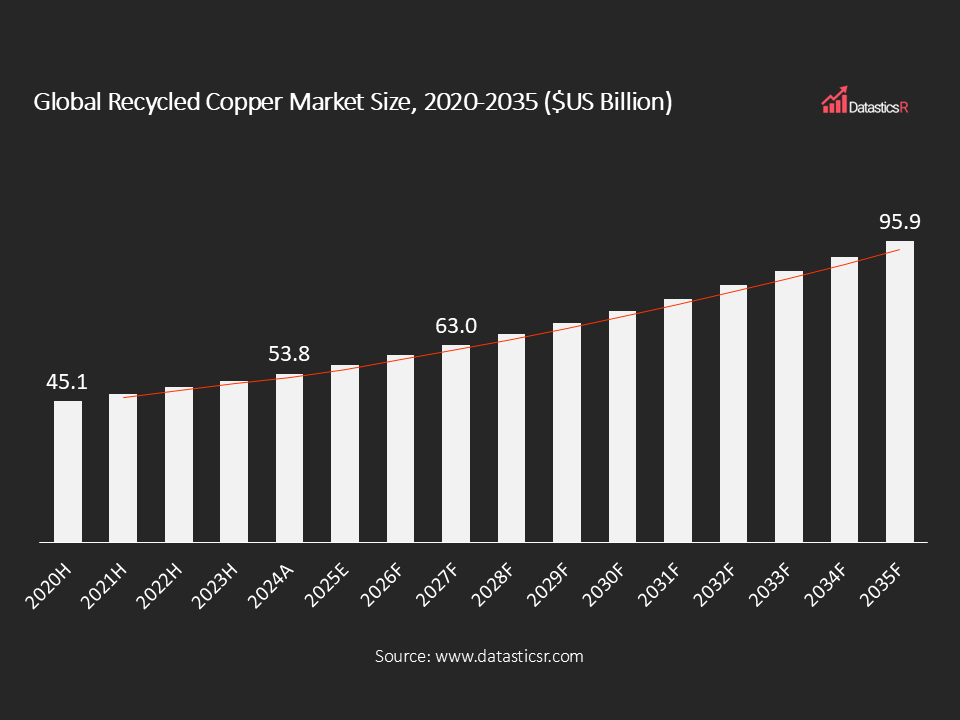

- Market Size in 2024: $US 53.8 Billion

- Forecast Market by 2035: $US 95.9 Billion

- CAGR for the Period 2025-2035: 5.4%

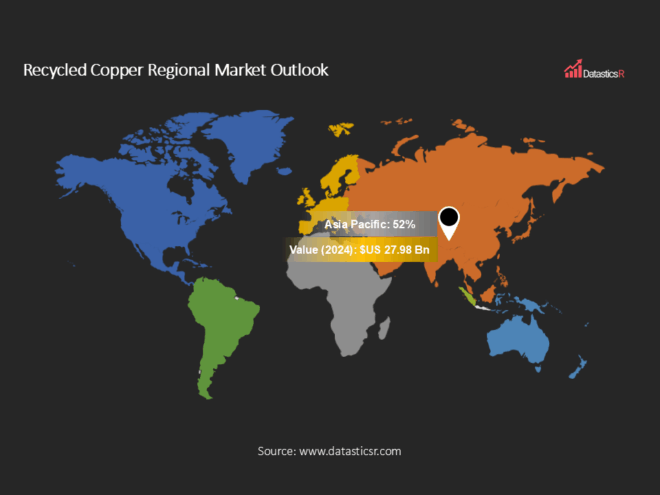

- Top Region in Terms of Market Share: Asia Pacific (52%)

- Key Players: Aurubis AG, Commercial Metals Company, Schnitzer Steel Industries, Inc., Umicore N.V., Kuusakoski Group Oy, Sims Metal Management Ltd., OmniSource, LLC, and Others.

Analyst Viewpoint:

Recycled Copper Market Overview:

| Drivers | Rising Demand from Renewable Energy and Electric Vehicles |

| Stringent Government Regulations and ESG Goals are Promoting Large-scale Copper Recycling |

Rising Demand from Renewable Energy and Electric Vehicles

Stringent Government Regulations and ESG Goals are Promoting Large-scale Copper Recycling

Recycled Copper Regional Market Outlook:

Key Companies in Recycled Copper Market:

Key Developments in Recycled Copper Market:

| 1. Hindalco unveils $10 billion investment plan: In August 2025, Hindalco Industries announced nvestments worth $10 billion over the next five years across aluminium, copper, and speciality alumina, chairman Kumar Mangalam Birla told shareholders at the company’s 66th Annual General Meeting on Thursday. |

| 2. Aurubis to ramp up new US copper recycling facility: In April 2024, Aurubis announced ramping up of its copper recycling smelter in the U.S. Aurubus has invested $800 million building the project, which took four years. Haag said it will process 180,000 metric tons of complex copper scrap and produce 70,000 tons of refined metal annually. |

Recycled Copper Market Attributes:

| ATTRIBUTE | DETAILS |

| Market Value, 2024 | $US 53.8 Billion |

| Forecasted Market Value, 2035 | $US 95.9 Billion |

| CAGR (2025-2035) | 5.4% |

| Analysis Period | 2025-2035 |

| Historic Period | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Volume Unit | Tons |

| Value Unit | $US Billion |

| Market Segmentation | By Source

By Grade

By Recycling Process

By End-use

By Region

|

| Companies Profiles |

|

| Customization Request | Available upon request |

1. Introduction

1.1. Report Scope

1.2. Market Segmentations and Definitions

1.3. Geographical Coverage

2. Executive Summary

2.1. Key Facts and Figures

2.2. Trends Impacting the Market

2.3. DatasticsR Growth Opportunity Matrix

3. Market Overview

3.1. Global Recycled Copper Market Analysis and Forecast, 2020-2035

3.1.1. Global Recycled Copper Market Size (Tons)

3.1.2. Global Recycled Copper Market Size ($US Bn)

3.2. Supply-side and Demand-side Trends

3.3. Technology Roadmap and Developments

3.4. Market Dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Porter’s Five Forces Analysis

3.6. PESTL Analysis

3.7. Industry SWOT Analysis

3.8. Regulatory Landscape

3.9. Value Chain Analysis

3.9.1. List of Waste Collectors

3.9.2. List of Recycling Companies

3.9.3. List of Dealers/Distributors

3.9.4. List of Potential Customers

3.10. Impact of Current Geopolitical Scenario on the Market

4. Technical Analysis

4.1. Product Specification Analysis

4.2. Details of Recycling Process

4.3. Technology Adoption and Emerging Technologies

4.4. R&D Trends and Patents Landscape

4.5. Cost Structure and Profitability Analysis

5. Global Production Output Analysis (Tons), by Region, 2024

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Import-export Analysis Volume (Tons) and Value ($US Bn), by Key Country, 2020-2024

7. Price Trend Analysis and Forecasting ($US/Ton), 2020-2035

7.1. Price Trend Analysis and Forecasting, by Source

7.2. Price Trend Analysis and Forecasting, by Region

8. Global Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

9. Global Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

10. Global Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

11. Global Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

12. Global Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Region, 2020-2035

13. North America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

14. North America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

15. North America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

16. North America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

17. U.S. Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

18. U.S. Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

19. U.S. Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

20. U.S. Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

21. Canada Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

22. Canada Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

23. Canada Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

24. Canada Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

25. Europe Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

26. Europe Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

27. Europe Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

28. Europe Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

29. Germany Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

30. Germany Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

31. Germany Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

32. Germany Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

33. U.K. Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

34. U.K. Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

35. U.K. Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

36. U.K. Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

37. France Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

38. France Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

39. France Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

40. France Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

41. Italy Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

42. Italy Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

43. Italy Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

44. Italy Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

45. Spain Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

46. Spain Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

47. Spain Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

48. Spain Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

49. Russia & CIS Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

50. Russia & CIS Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

51. Russia & CIS Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

52. Russia & CIS Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

53. Rest of Europe Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

54. Rest of Europe Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

55. Rest of Europe Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

56. Rest of Europe Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

57. Asia Pacific Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

58. Asia Pacific Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

59. Asia Pacific Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

60. Asia Pacific Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

61. China Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

62. China Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

63. China Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

64. China Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

65. India Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

66. India Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

67. India Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

68. India Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

69. Japan Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

70. Japan Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

71. Japan Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

72. Japan Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

73. South Korea Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

74. South Korea Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

75. South Korea Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

76. South Korea Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

77. Taiwan Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

78. Taiwan Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

79. Taiwan Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Fabrication Technology, 2020-2035

80. Taiwan Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

81. Taiwan Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

82. Australia Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

83. Australia Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

84. Australia Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Fabrication Technology, 2020-2035

85. Australia Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

86. Australia Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

87. ASEAN Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

88. ASEAN Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

89. ASEAN Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

90. ASEAN Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

91. Rest of Asia Pacific Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

92. Rest of Asia Pacific Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

93. Rest of Asia Pacific Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

94. Rest of Asia Pacific Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

95. Latin America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

96. Latin America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

97. Latin America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

98. Latin America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

99. Mexico Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

100. Mexico Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

101. Mexico Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

102. Mexico Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

103. Brazil Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

104. Brazil Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

105. Brazil Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

106. Brazil Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

107. Argentina Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

108. Argentina Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

109. Argentina Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

110. Argentina Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

111. Rest of Latin America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

112. Rest of Latin America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

113. Rest of Latin America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

114. Rest of Latin America Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

115. Middle East and Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

116. Middle East and Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

117. Middle East and Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

118. Middle East and Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

119. Saudi Arabia Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

120. Saudi Arabia Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

121. Saudi Arabia Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

122. Saudi Arabia Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

123. UAE Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

124. UAE Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

125. UAE Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

126. UAE Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

127. South Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

128. South Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

129. South Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

130. South Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

131. Rest of Middle East and Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Source, 2020-2035

132. Rest of Middle East and Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

133. Rest of Middle East and Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by Recycling Process, 2020-2035

134. Rest of Middle East and Africa Recycled Copper Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

135. Competition Landscape

135.1. Market Share Analysis (%), by Company, 2024

135.2. Competitive Benchmarking

135.3. Company Profiles

135.3.1. Aurubis AG

135.3.1.1. Company Overview

135.3.1.2. Product Portfolio

135.3.1.3. Financials

135.3.1.4. Geographical Footprint

135.3.1.5. SWOT Analysis

135.3.1.6. Recent Developments and Strategies

135.3.2. Commercial Metals Company

135.3.2.1. Company Overview

135.3.2.2. Product Portfolio

135.3.2.3. Financials

135.3.2.4. Geographical Footprint

135.3.2.5. SWOT Analysis

135.3.2.6. Recent Developments and Strategies

135.3.3. Schnitzer Steel Industries, Inc.

135.3.3.1. Company Overview

135.3.3.2. Product Portfolio

135.3.3.3. Financials

135.3.3.4. Geographical Footprint

135.3.3.5. SWOT Analysis

135.3.3.6. Recent Developments and Strategies

135.3.4. Umicore N.V.

135.3.4.1. Company Overview

135.3.4.2. Product Portfolio

135.3.4.3. Financials

135.3.4.4. Geographical Footprint

135.3.4.5. SWOT Analysis

135.3.4.6. Recent Developments and Strategies

135.3.5. Kuusakoski Group Oy

135.3.5.1. Company Overview

135.3.5.2. Product Portfolio

135.3.5.3. Financials

135.3.5.4. Geographical Footprint

135.3.5.5. SWOT Analysis

135.3.5.6. Recent Developments and Strategies

135.3.6. Sims Metal Management Ltd.

135.3.6.1. Company Overview

135.3.6.2. Product Portfolio

135.3.6.3. Financials

135.3.6.4. Geographical Footprint

135.3.6.5. SWOT Analysis

135.3.6.6. Recent Developments and Strategies

135.3.7. OmniSource, LLC

135.3.7.1. Company Overview

135.3.7.2. Product Portfolio

135.3.7.3. Financials

135.3.7.4. Geographical Footprint

135.3.7.5. SWOT Analysis

135.3.7.6. Recent Developments and Strategies

135.3.8. Elgin Recycling

135.3.8.1. Company Overview

135.3.8.2. Product Portfolio

135.3.8.3. Financials

135.3.8.4. Geographical Footprint

135.3.8.5. SWOT Analysis

135.3.8.6. Recent Developments and Strategies

135.3.9. Elgin Recycling

135.3.9.1. Company Overview

135.3.9.2. Product Portfolio

135.3.9.3. Financials

135.3.9.4. Geographical Footprint

135.3.9.5. SWOT Analysis

135.3.9.6. Recent Developments and Strategies

135.3.10. Pacific Metal Pty Ltd

135.3.10.1. Company Overview

135.3.10.2. Product Portfolio

135.3.10.3. Financials

135.3.10.4. Geographical Footprint

135.3.10.5. SWOT Analysis

135.3.10.6. Recent Developments and Strategies

135.3.11. Universal Recycling

135.3.11.1. Company Overview

135.3.11.2. Product Portfolio

135.3.11.3. Financials

135.3.11.4. Geographical Footprint

135.3.11.5. SWOT Analysis

135.3.11.6. Recent Developments and Strategies

135.3.12. Wilton Recycling

135.3.12.1. Company Overview

135.3.12.2. Product Portfolio

135.3.12.3. Financials

135.3.12.4. Geographical Footprint

135.3.12.5. SWOT Analysis

135.3.12.6. Recent Developments and Strategies

135.3.13. LKM Recycling

135.3.13.1. Company Overview

135.3.13.2. Product Portfolio

135.3.13.3. Financials

135.3.13.4. Geographical Footprint

135.3.13.5. SWOT Analysis

135.3.13.6. Recent Developments and Strategies

135.3.14. European Recycled Metal

135.3.14.1. Company Overview

135.3.14.2. Product Portfolio

135.3.14.3. Financials

135.3.14.4. Geographical Footprint

135.3.14.5. SWOT Analysis

135.3.14.6. Recent Developments and Strategies

135.3.15. SA Recycling LLC

135.3.15.1. Company Overview

135.3.15.2. Product Portfolio

135.3.15.3. Financials

135.3.15.4. Geographical Footprint

135.3.15.5. SWOT Analysis

135.3.15.6. Recent Developments and Strategies

135.3.16. Aaron Metals

135.3.16.1. Company Overview

135.3.16.2. Product Portfolio

135.3.16.3. Financials

135.3.16.4. Geographical Footprint

135.3.16.5. SWOT Analysis

135.3.16.6. Recent Developments and Strategies

135.3.17. Others

136. Appendix