Printing Inks Market

| Format: PDF/PPT/Excel

| Product ID:

3665

| Report Version:

August 2025

- Report Preview

- Table of Content

- Request Customization

Market Snappshot

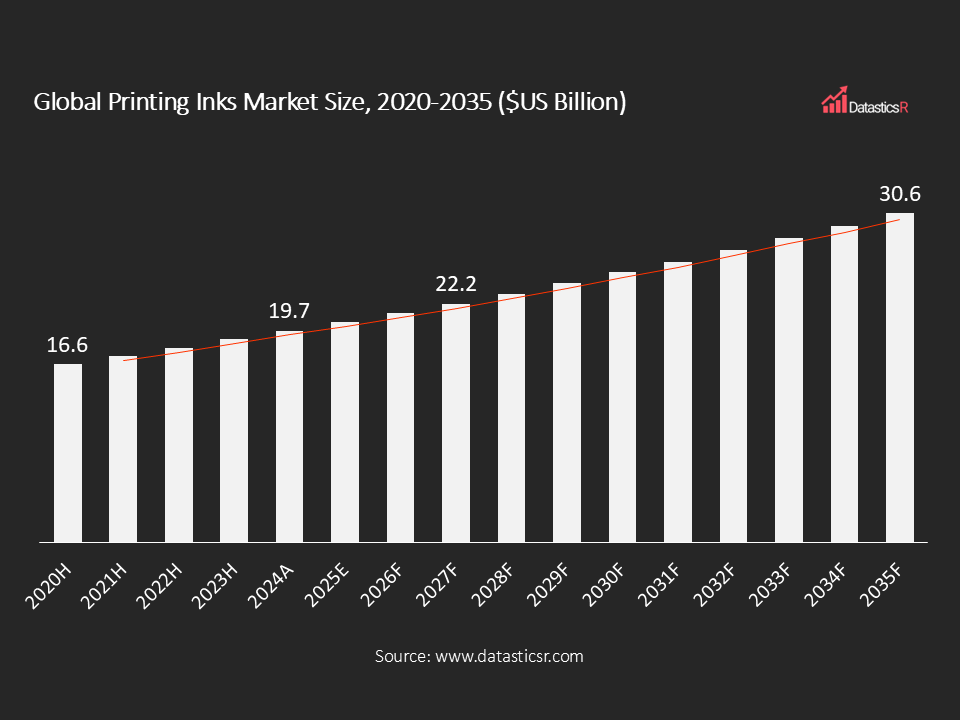

- Market Size in 2024: $US 19.7 Billion

- Forecast Market by 2035: $US 30.6 Billion

- CAGR for the Period 2025-2035: 4.1%

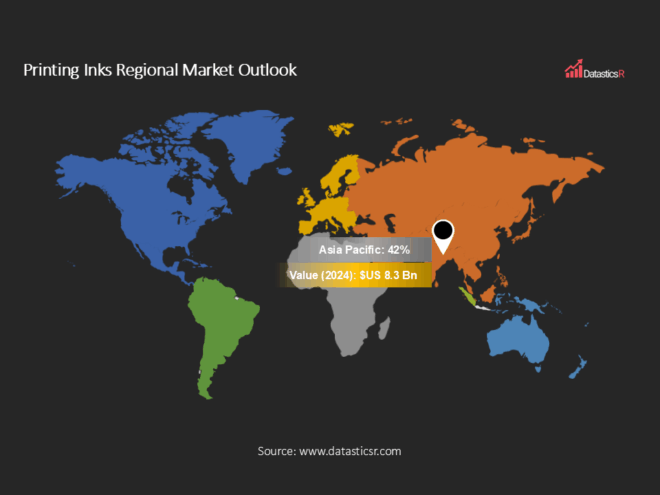

- Top Region in Terms of Market Share: Asia Pacific (42%)

- Key Players: DIC Corporation, Flint Group, Siegwerk Druckfarben AG & Co. KGaA, Toyo Ink SC Holdings, Sakata INX Corporation, T&K Toka Co., Ltd., Fujifilm Ink Solutions, and Others.

Analyst Viewpoint:

Printing Inks Market Overview:

| Drivers | Rising Demand from Packaging Industry |

| Increasing Adoption of Water-based, UV-curable, and Bio-based inks to meet Regulatory Requirements |

Rising Demand from Packaging Industry

Increasing Adoption of Water-based, UV-curable, and Bio-based Inks to Meet Regulatory Requirements

Printing Inks Regional Market Outlook:

Key Companies in Printing Inks Market:

Key Developments in Printing Inks Market:

| 1. Toyo Printing Inks Begins Operations at Innovative Green Factory in Turkey: In May 2025, Toyo Printing Inks, a member of artience Group, inaugurated a new $ US 70 million facility in Manisa Organized Industrial Zone in northwestern Turkey. The eco-friendly manufacturing facility is built with cutting-edge infrastructure and environmentally friendly processes, with a vision to double capacity and expand products—such as lamination adhesives—while catering to local and regional markets. |

| 2. Flint Group Opens Water-Based & Energy-Curable Ink Plant in India: In December 2024, Flint Group inaugurated a new manufacturing facility in Savli, Vadodara (India), to produce water-based inks and energy-curable coatings for paper & board and label segments. The 9,000 m² plant, which is on the same location as its packaging facility, is expected to run at full capacity in early 2025, enhancing the company’s emphasis on sustainable, high-performance ink solutions. |

Printing Inks Market Attributes:

| ATTRIBUTE | DETAILS |

| Market Value, 2024 | $US 19.7 Billion |

| Forecasted Market Value, 2035 | $US 30.6 Billion |

| CAGR (2025-2035) | 4.1% |

| Analysis Period | 2025-2035 |

| Historic Period | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Volume Unit | Tons |

| Value Unit | $US billion |

| Market Segmentation | By Ink Type

By Resin Type

By Printing Technology

By Colour

By Substrate

By Application

By End-use

By Region

|

| Companies Profiles |

|

| Customization Request | Available upon request |

1. Introduction

1.1. Report Scope

1.2. Market Segmentations and Definitions

1.3. Geographical Coverage

2. Executive Summary

2.1. Key Facts and Figures

2.2. Trends Impacting the Market

2.3. DatasticsR Growth Opportunity Matrix

3. Market Overview

3.1. Global Printing Inks Market Analysis and Forecast, 2020-2035

3.1.1. Global Printing Inks Market Size (Tons)

3.1.2. Global Printing Inks Market Size ($US Bn)

3.2. Supply-side and Demand-side Trends

3.3. Technology Roadmap and Developments

3.4. Market Dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Porter’s Five Forces Analysis

3.6. PESTL Analysis

3.7. Industry SWOT Analysis

3.8. Regulatory Landscape

3.9. Value Chain Analysis

3.9.1. List of Raw Materials Suppliers

3.9.2. List of Manufacturers

3.9.3. List of Dealers/Distributors

3.9.4. List of Potential Customers

3.10. Impact of Current Geopolitical Scenario on the Market

4. Technical Analysis

4.1. Product Specification Analysis

4.2. Details of Manufacturing Process

4.3. Technology Adoption and Emerging Technologies

4.4. R&D Trends and Patents Landscape

4.5. Cost Structure and Profitability Analysis

5. Global Production Output Analysis (Tons), by Region, 2024

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Import-export Analysis Volume (Tons) and Value ($US Bn), by Key Country, 2020-2024

7. Price Trend Analysis and Forecasting ($US/Ton), 2020-2035

7.1. Price Trend Analysis and Forecasting, by Ink Type

7.2. Price Trend Analysis and Forecasting, by Region

8. Global Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

9. Global Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

10. Global Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

11. Global Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

12. Global Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

13. Global Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

14. Global Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

15. Global Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Region, 2020-2035

16. North America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

17. North America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

18. North America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

19. North America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

20. North America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

21. North America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

22. North America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

23. U.S. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

24. U.S. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

25. U.S. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

26. U.S. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

27. U.S. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

28. U.S. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

29. U.S. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

30. Canada Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

31. Canada Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

32. Canada Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

33. Canada Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

34. Canada Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

35. Canada Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

36. Canada Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

37. Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

38. Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

39. Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

40. Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

41. Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

42. Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

43. Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

44. Germany Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

45. Germany Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

46. Germany Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

47. Germany Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

48. Germany Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

49. Germany Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

50. Germany Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

51. U.K. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

52. U.K. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

53. U.K. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

54. U.K. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

55. U.K. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

56. U.K. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

57. U.K. Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

58. France Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

59. France Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

60. France Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

61. France Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

62. France Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

63. France Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

64. France Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

65. Italy Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

66. Italy Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

67. Italy Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

68. Italy Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

69. Italy Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

70. Italy Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

71. Spain Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

72. Spain Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

73. Spain Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

74. Spain Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

75. Spain Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

76. Spain Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

77. Spain Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

78. Russia & CIS Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

79. Russia & CIS Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

80. Russia & CIS Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

81. Russia & CIS Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

82. Russia & CIS Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

83. Russia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

84. Russia & CIS Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

85. Rest of Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

86. Rest of Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

87. Rest of Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

88. Rest of Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

89. Rest of Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

90. Rest of Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

91. Rest of Europe Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

92. Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

93. Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

94. Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

95. Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

96. Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

97. Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

98. China Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

99. China Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

100. China Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

101. China Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

102. China Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

103. China Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

104. India Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

105. India Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

106. India Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

107. India Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

108. India Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

109. India Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

110. India Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

111. Japan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

112. Japan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

113. Japan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

114. Japan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

115. Japan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

116. Japan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

117. Japan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

118. South Korea Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

119. South Korea Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

120. South Korea Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

121. South Korea Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

122. South Korea Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

123. South Korea Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

124. South Korea Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

125. Taiwan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

126. Taiwan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

127. Taiwan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

128. Taiwan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

129. Taiwan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

130. Taiwan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

131. Taiwan Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

132. Australia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

133. Australia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

134. Australia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

135. Australia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

136. Australia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

137. Australia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

138. Australia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

139. ASEAN Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

140. ASEAN Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

141. ASEAN Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

142. ASEAN Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

143. ASEAN Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

144. ASEAN Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

145. ASEAN Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

146. Rest of Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

147. Rest of Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

148. Rest of Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

149. Rest of Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

150. Rest of Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

151. Rest of Asia Pacific Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

152. Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

153. Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

154. Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

155. Latin America Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

156. Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

157. Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

158. Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

159. Mexico Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

160. Mexico Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

161. Mexico Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

162. Mexico Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

163. Mexico Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

164. Mexico Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

165. Mexico Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

166. Mexico Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

167. Brazil Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

168. Brazil Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

169. Brazil Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

170. Brazil Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

171. Brazil Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

172. Brazil Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

173. Brazil Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

174. Argentina Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

175. Argentina Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

176. Argentina Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

177. Argentina Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

178. Argentina Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

179. Argentina Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

180. Rest of Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

181. Rest of Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

182. Rest of Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

183. Rest of Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

184. Rest of Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

185. Rest of Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

186. Rest of Latin America Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

187. Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

188. Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

189. Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

190. Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

191. Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

192. Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

193. Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

194. Saudi Arabia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

195. Saudi Arabia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

196. Saudi Arabia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

197. Saudi Arabia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

198. Saudi Arabia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

199. Saudi Arabia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

200. Saudi Arabia Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

201. UAE Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

202. UAE Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

203. UAE Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

204. UAE Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

205. UAE Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

206. UAE Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

207. UAE Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

208. South Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

209. South Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

210. South Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

211. South Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

212. South Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

213. South Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

214. South Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

215. Rest of Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Ink Type, 2020-2035

216. Rest of Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Resin Type, 2020-2035

217. Rest of Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Printing Technology, 2020-2035

218. Rest of Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Colour, 2020-2035

219. Rest of Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

220. Rest of Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

221. Rest of Middle East and Africa Printing Inks Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

222. Competition Landscape

222.1. Market Share Analysis (%), by Company, 2024

222.2. Competitive Benchmarking

222.3. Company Profiles

222.3.1. DIC Corporation

222.3.1.1. Company Overview

222.3.1.2. Product Portfolio

222.3.1.3. Financials

222.3.1.4. Geographical Footprint

222.3.1.5. SWOT Analysis

222.3.1.6. Recent Developments and Strategies

222.3.2. Flint Group

222.3.2.1. Company Overview

222.3.2.2. Product Portfolio

222.3.2.3. Financials

222.3.2.4. Geographical Footprint

222.3.2.5. SWOT Analysis

222.3.2.6. Recent Developments and Strategies

222.3.3. Siegwerk Druckfarben AG & Co. KGaA

222.3.3.1. Company Overview

222.3.3.2. Product Portfolio

222.3.3.3. Financials

222.3.3.4. Geographical Footprint

222.3.3.5. SWOT Analysis

222.3.3.6. Recent Developments and Strategies

222.3.4. Toyo Ink SC Holdings

222.3.4.1. Company Overview

222.3.4.2. Product Portfolio

222.3.4.3. Financials

222.3.4.4. Geographical Footprint

222.3.4.5. SWOT Analysis

222.3.4.6. Recent Developments and Strategies

222.3.5. Sakata INX Corporation

222.3.5.1. Company Overview

222.3.5.2. Product Portfolio

222.3.5.3. Financials

222.3.5.4. Geographical Footprint

222.3.5.5. SWOT Analysis

222.3.5.6. Recent Developments and Strategies

222.3.6. T&K Toka Co., Ltd.

222.3.6.1. Company Overview

222.3.6.2. Product Portfolio

222.3.6.3. Financials

222.3.6.4. Geographical Footprint

222.3.6.5. SWOT Analysis

222.3.6.6. Recent Developments and Strategies

222.3.7. Fujifilm Ink Solutions

222.3.7.1. Company Overview

222.3.7.2. Product Portfolio

222.3.7.3. Financials

222.3.7.4. Geographical Footprint

222.3.7.5. SWOT Analysis

222.3.7.6. Recent Developments and Strategies

222.3.8. Huber Group

222.3.8.1. Company Overview

222.3.8.2. Product Portfolio

222.3.8.3. Financials

222.3.8.4. Geographical Footprint

222.3.8.5. SWOT Analysis

222.3.8.6. Recent Developments and Strategies

222.3.9. Nazdar Ink Technologies

222.3.9.1. Company Overview

222.3.9.2. Product Portfolio

222.3.9.3. Financials

222.3.9.4. Geographical Footprint

222.3.9.5. SWOT Analysis

222.3.9.6. Recent Developments and Strategies

222.3.10. Wikoff Color Corporation

222.3.10.1. Company Overview

222.3.10.2. Product Portfolio

222.3.10.3. Financials

222.3.10.4. Geographical Footprint

222.3.10.5. SWOT Analysis

222.3.10.6. Recent Developments and Strategies

222.3.11. Marabu GmbH & Co. KG

222.3.11.1. Company Overview

222.3.11.2. Product Portfolio

222.3.11.3. Financials

222.3.11.4. Geographical Footprint

222.3.11.5. SWOT Analysis

222.3.11.6. Recent Developments and Strategies

222.3.12. Tokyo Printing Ink Mfg. Co., Ltd.

222.3.12.1. Company Overview

222.3.12.2. Product Portfolio

222.3.12.3. Financials

222.3.12.4. Geographical Footprint

222.3.12.5. SWOT Analysis

222.3.12.6. Recent Developments and Strategies

222.3.13. Dainichiseika Color & Chemicals Mfg. Co.

222.3.13.1. Company Overview

222.3.13.2. Product Portfolio

222.3.13.3. Financials

222.3.13.4. Geographical Footprint

222.3.13.5. SWOT Analysis

222.3.13.6. Recent Developments and Strategies

222.3.14. RUCO Druckfarben

222.3.14.1. Company Overview

222.3.14.2. Product Portfolio

222.3.14.3. Financials

222.3.14.4. Geographical Footprint

222.3.14.5. SWOT Analysis

222.3.14.6. Recent Developments and Strategies

222.3.15. Kao Collins Inc.

222.3.15.1. Company Overview

222.3.15.2. Product Portfolio

222.3.15.3. Financials

222.3.15.4. Geographical Footprint

222.3.15.5. SWOT Analysis

222.3.16. Encres Dubuit

222.3.16.1. Company Overview

222.3.16.2. Product Portfolio

222.3.16.3. Financials

222.3.16.4. Geographical Footprint

222.3.16.5. SWOT Analysis

222.3.17. Flint CPS Inks North America LLC

222.3.17.1. Company Overview

222.3.17.2. Product Portfolio

222.3.17.3. Financials

222.3.17.4. Geographical Footprint

222.3.17.5. SWOT Analysis

222.3.18. Others

223. Appendix