Functional Coatings Market

| Format: PDF/PPT/Excel

| Product ID:

3657

| Report Version:

August 2025

- Report Preview

- Table of Content

- Request Customization

Market Snappshot

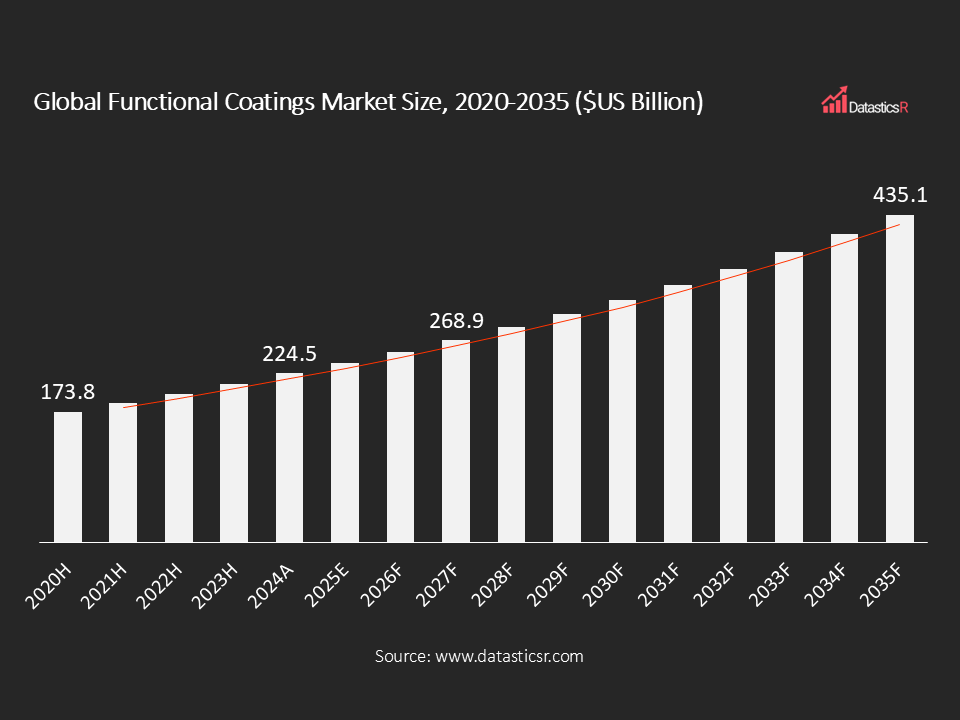

- Market Size in 2024: $US 224.5 Billion

- Forecast Market by 2035: $US 435.1 Billion

- CAGR for the Period 2025-2035: 6.2%

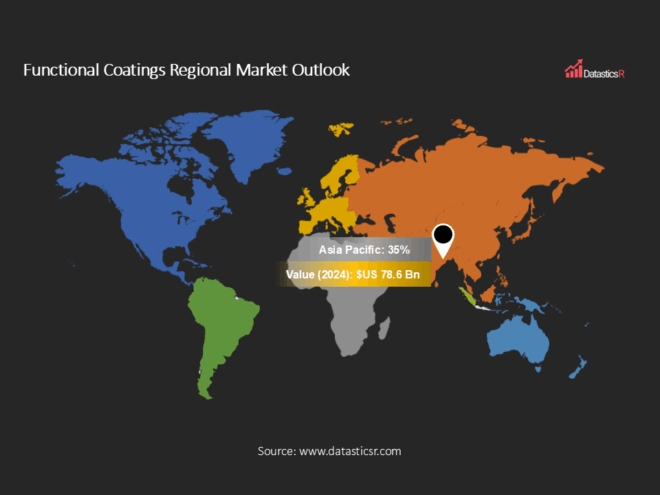

- Top Region in Terms of Market Share: Asia Pacific (35%)

- Key Players: PPG Industries, Inc., AkzoNobel N.V., Sherwin-Williams Company, BASF, Axalta Coating Systems, Hempel A/S, Nippon Paint Holdings Co., Ltd, Jotun Group, and Others.

Analyst Viewpoint:

Functional Coatings Market Overview:

| Drivers | Increasing Need for Surfaces with Anti-corrosion, Heat and Antimicrobial Properties |

| Increasing Adoption of Functional Coatings in Aerospace |

Increasing Need for Surfaces with Anti-corrosion, Heat and Antimicrobial Properties

Increasing Adoption of Functional Coatings in Aerospace

Functional Coatings Regional Market Outlook:

Key Companies in Functional Coatings Market:

Key Developments in Functional Coatings Market:

| 1. Siegwerk Establishes Global Functional Coatings Unit for Sustainable Packaging: In April 2024, Siegwerk introduced a special global business unit that is dedicated to functional coatings specifically designed for sustainable packaging in a circular economy context. With its acquisition of Allinova, the company strengthened its expertise in sustainable coating solutions and further solidified its role as an enabler of circular packaging in a wide range of applications and technologies. |

| 2. OCSiAl Opens Graphene Nanotube Production Facility in Serbia: In October 2024, OCSiAl opened a state-of-the-art production plant in Serbia with TUBALL graphene nanotube synthesis, dispersion, and concentrate lines augmented by a research center and quality control laboratories. This growth is focused on increasing the commercial supply of advanced nanomaterials for functional coating technologies like anti-corrosion, conductive, and thermal barrier coatings. |

Functional Coatings Market Attributes:

| ATTRIBUTE | DETAILS |

| Market Value, 2024 | $US 224.5 Billion |

| Forecasted Market Value, 2035 | $US 435.1 Billion |

| CAGR (2025-2035) | 6.2% |

| Analysis Period | 2025-2035 |

| Historic Period | 2020-2023 |

| Base Year | 2024 |

| Forecast Period | 2025-2035 |

| Volume Unit | Tons |

| Value Unit | $US billion |

| Market Segmentation | By Type

By Materials

By Technology

By Application

By End-use

By Region

|

| Companies Profiles |

|

| Customization Request | Available upon request |

1. Introduction

1.1. Report Scope

1.2. Market Segmentations and Definitions

1.3. Geographical Coverage

2. Executive Summary

2.1. Key Facts and Figures

2.2. Trends Impacting the Market

2.3. DatasticsR Growth Opportunity Matrix

3. Market Overview

3.1. Global Functional Coatings Market Analysis and Forecast, 2020-2035

3.1.1. Global Functional Coatings Market Size (Tons)

3.1.2. Global Functional Coatings Market Size ($US Bn)

3.2. Supply-side and Demand-side Trends

3.3. Technology Roadmap and Developments

3.4. Market Dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Porter’s Five Forces Analysis

3.6. PESTL Analysis

3.7. Industry SWOT Analysis

3.8. Regulatory Landscape

3.9. Value Chain Analysis

3.9.1. List of Raw Material Suppliers

3.9.2. List of Manufacturers

3.9.3. List of Dealers/Distributors

3.9.4. List of Potential Customers

3.10. Impact of Current Geopolitical Scenario on the Market

4. Technical Analysis

4.1. Product Specification Analysis

4.2. Details of Manufacturing Process

4.3. Technology Adoption and Emerging Technologies

4.4. R&D Trends and Patents Landscape

4.5. Cost Structure and Profitability Analysis

5. Global Production Output Analysis (Tons), by Region, 2024

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Import-export Analysis Volume (Tons) and Value ($US Bn), by Key Country, 2020-2024

7. Price Trend Analysis and Forecasting ($US/Ton), 2020-2035

7.1. Price Trend Analysis and Forecasting, by Type

7.2. Price Trend Analysis and Forecasting, by Region

8. Global Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

9. Global Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

10. Global Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

11. Global Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

12. Global Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

13. Global Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Region, 2020-2035

14. North America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

15. North America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

16. North America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

17. North America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

18. North America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

19. U.S. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

20. U.S. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

21. U.S. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

22. U.S. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

23. U.S. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

24. Canada Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

25. Canada Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

26. Canada Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

27. Canada Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

28. Canada Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

29. Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

30. Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

31. Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

32. Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

33. Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

34. Germany Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

35. Germany Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

36. Germany Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

37. Germany Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

38. Germany Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

39. U.K. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

40. U.K. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

41. U.K. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

42. U.K. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

43. U.K. Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

44. France Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

45. France Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

46. France Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

47. France Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

48. France Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

49. Italy Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

50. Italy Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

51. Italy Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

52. Italy Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

53. Italy Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

54. Spain Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

55. Spain Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

56. Spain Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

57. Spain Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

58. Spain Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

59. Russia & CIS Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

60. Russia & CIS Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

61. Russia & CI Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

62. Russia & CIS Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

63. Russia & CIS Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

64. Rest of Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

65. Rest of Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

66. Rest of Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

67. Rest of Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

68. Rest of Europe Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

69. Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

70. Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

71. Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

72. Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

73. Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

74. China Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

75. China Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

76. China Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

77. China Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

78. China Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

79. India Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

80. India Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

81. India Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

82. India Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

83. India Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

84. Japan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

85. Japan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

86. Japan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

87. Japan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

88. Japan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

89. South Korea Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

90. South Korea Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

91. South Korea Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

92. South Korea Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

93. South Korea Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

94. South Korea Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

95. Taiwan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

96. Taiwan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

97. Taiwan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

98. Taiwan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

99. Taiwan Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

100. Australia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

101. Australia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

102. Australia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

103. Australia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

104. Australia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

105. ASEAN Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

106. ASEAN Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

107. ASEAN Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

108. ASEAN Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

109. ASEAN Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

110. Rest of Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

111. Rest of Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

112. Rest of Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

113. Rest of Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

114. Rest of Asia Pacific Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

115. Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

116. Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

117. Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

118. Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

119. Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

120. Mexico Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

121. Mexico Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

122. Mexico Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

123. Mexico Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

124. Mexico Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

125. Brazil Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

126. Brazil Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

127. Brazil Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

128. Brazil Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

129. Brazil Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

130. Argentina Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

131. Argentina Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

132. Argentina Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

133. Argentina Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

134. Argentina Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

135. Rest of Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

136. Rest of Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

137. Rest of Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

138. Rest of Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

139. Rest of Latin America Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

140. Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

141. Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

142. Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

143. Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

144. Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

145. Saudi Arabia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

146. Saudi Arabia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

147. Saudi Arabia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

148. Saudi Arabia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

149. Saudi Arabia Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

150. UAE Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

151. UAE Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

152. UAE Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

153. UAE Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Substrate, 2020-2035

154. UAE Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

155. UAE Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

156. South Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

157. South Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

158. South Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

159. South Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

160. South Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

161. Rest of Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Type, 2020-2035

162. Rest of Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Materials, 2020-2035

163. Rest of Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Technology, 2020-2035

164. Rest of Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

165. Rest of Middle East and Africa Functional Coatings Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

166. Competition Landscape

166.1. Market Share Analysis (%), by Company, 2024

166.2. Competitive Benchmarking

166.3. Company Profiles

166.3.1. PPG Industries, Inc.

166.3.1.1. Company Overview

166.3.1.2. Product Portfolio

166.3.1.3. Financials

166.3.1.4. Geographical Footprint

166.3.1.5. SWOT Analysis

166.3.1.6. Recent Developments and Strategies

166.3.2. AkzoNobel N.V.

166.3.2.1. Company Overview

166.3.2.2. Product Portfolio

166.3.2.3. Financials

166.3.2.4. Geographical Footprint

166.3.2.5. SWOT Analysis

166.3.2.6. Recent Developments and Strategies

166.3.3. Sherwin-Williams Company

166.3.3.1. Company Overview

166.3.3.2. Product Portfolio

166.3.3.3. Financials

166.3.3.4. Geographical Footprint

166.3.3.5. SWOT Analysis

166.3.3.6. Recent Developments and Strategies

166.3.4. BASF

166.3.4.1. Company Overview

166.3.4.2. Product Portfolio

166.3.4.3. Financials

166.3.4.4. Geographical Footprint

166.3.4.5. SWOT Analysis

166.3.4.6. Recent Developments and Strategies

166.3.5. Axalta Coating Systems

166.3.5.1. Company Overview

166.3.5.2. Product Portfolio

166.3.5.3. Financials

166.3.5.4. Geographical Footprint

166.3.5.5. SWOT Analysis

166.3.5.6. Recent Developments and Strategies

166.3.6. Hempel A/S

166.3.6.1. Company Overview

166.3.6.2. Product Portfolio

166.3.6.3. Financials

166.3.6.4. Geographical Footprint

166.3.6.5. SWOT Analysis

166.3.6.6. Recent Developments and Strategies

166.3.7. Nippon Paint Holdings Co., Ltd.

166.3.7.1. Company Overview

166.3.7.2. Product Portfolio

166.3.7.3. Financials

166.3.7.4. Geographical Footprint

166.3.7.5. SWOT Analysis

166.3.7.6. Recent Developments and Strategies

166.3.8. Jotun Group

166.3.8.1. Company Overview

166.3.8.2. Product Portfolio

166.3.8.3. Financials

166.3.8.4. Geographical Footprint

166.3.8.5. SWOT Analysis

166.3.8.6. Recent Developments and Strategies

166.3.9. RPM International Inc.

166.3.9.1. Company Overview

166.3.9.2. Product Portfolio

166.3.9.3. Financials

166.3.9.4. Geographical Footprint

166.3.9.5. SWOT Analysis

166.3.9.6. Recent Developments and Strategies

166.3.10. Kansai Paint Co., Ltd.

166.3.10.1. Company Overview

166.3.10.2. Product Portfolio

166.3.10.3. Financials

166.3.10.4. Geographical Footprint

166.3.10.5. SWOT Analysis

166.3.10.6. Recent Developments and Strategies

166.3.11. Evonik Industries AG

166.3.11.1. Company Overview

166.3.11.2. Product Portfolio

166.3.11.3. Financials

166.3.11.4. Geographical Footprint

166.3.11.5. SWOT Analysis

166.3.11.6. Recent Developments and Strategies

166.3.12. Covestro AG

166.3.12.1. Company Overview

166.3.12.2. Product Portfolio

166.3.12.3. Financials

166.3.12.4. Geographical Footprint

166.3.12.5. SWOT Analysis

166.3.12.6. Recent Developments and Strategies

166.3.13. Beckers Group

166.3.13.1. Company Overview

166.3.13.2. Product Portfolio

166.3.13.3. Financials

166.3.13.4. Geographical Footprint

166.3.13.5. SWOT Analysis

166.3.13.6. Recent Developments and Strategies

166.3.14. Berger Paints

166.3.14.1. Company Overview

166.3.14.2. Product Portfolio

166.3.14.3. Financials

166.3.14.4. Geographical Footprint

166.3.14.5. SWOT Analysis

166.3.14.6. Recent Developments and Strategies

166.3.15. Hempel A/S

166.3.15.1. Company Overview

166.3.15.2. Product Portfolio

166.3.15.3. Financials

166.3.15.4. Geographical Footprint

166.3.15.5. SWOT Analysis

166.3.16. Wacker Chemie AG

166.3.16.1. Company Overview

166.3.16.2. Product Portfolio

166.3.16.3. Financials

166.3.16.4. Geographical Footprint

166.3.16.5. SWOT Analysis

166.3.17. Others

167. Appendix