Copper Pipes and Tubes Market

| Format: PDF/PPT/Excel

| Product ID:

3589

| Report Version:

August 2025

- Report Preview

- Table of Content

- Request Customization

Market Snappshot

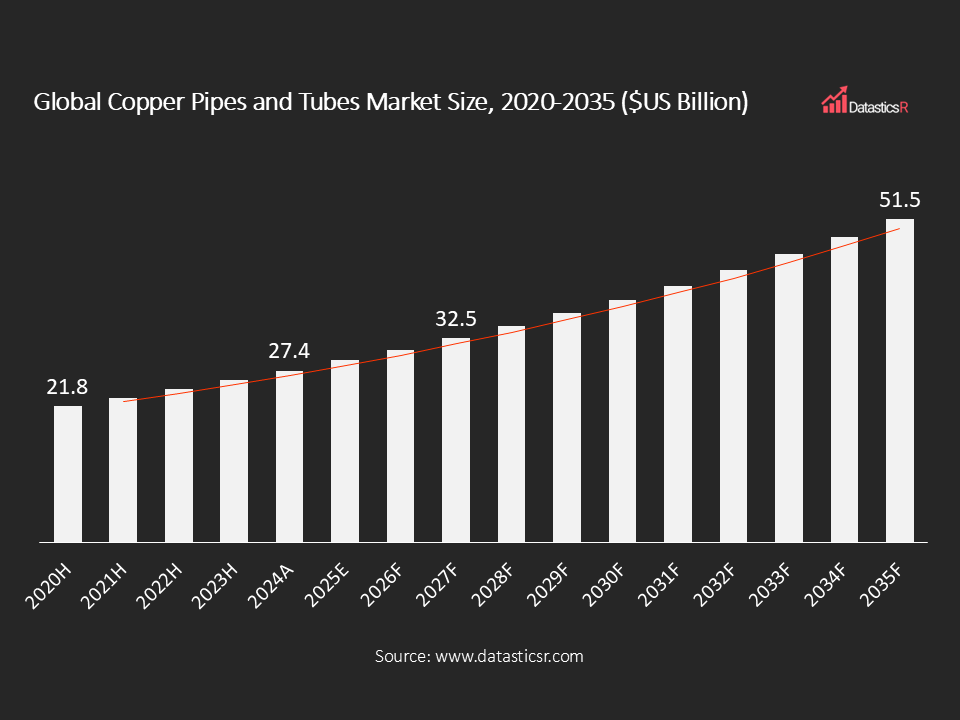

- Market Size in 2024: $US 27.4 Billion

- Forecast Market by 2035: $US 51.5 Billion

- CAGR for the Period 2025-2035: 5.9%

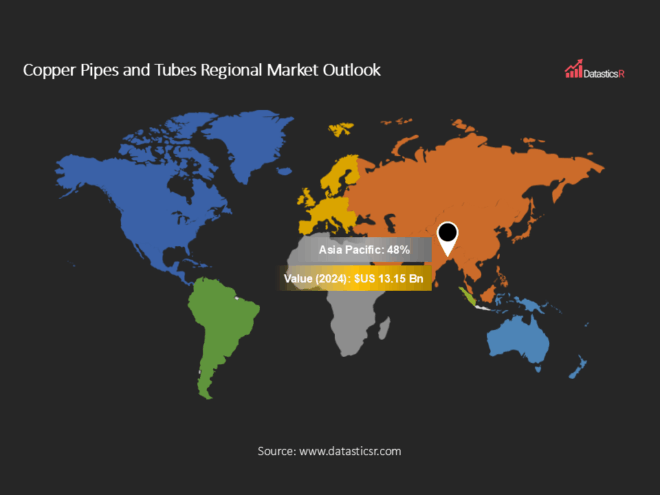

- Top Region in Terms of Market Share: Asia Pacific (48%)

- Key Players: Furukawa Electric Co., Ltd., Global Brass and Copper Holdings, Inc., ElvalHalcor, Mueller Industries, Aurubis AG, Cerro Flow Products LLC, and others.

Analyst Viewpoint:

Copper Pipes and Tubes Market Overview:

| Drivers | Growing Global HVAC and Refrigeration Industry Expansion Significantly Boosts Demand for Durable, Efficient Copper Pipes and Tubes |

| Increasing Global Demand for Thermally Efficient Heat Exchange Equipment Accelerates Adoption of Copper Pipes and Tubes Worldwide |

Growing Global HVAC and Refrigeration Industry Expansion Significantly Boosts Demand for Durable, Efficient Copper Pipes and Tubes

Increasing Global Demand for Thermally Efficient Heat Exchange Equipment Accelerates Adoption of Copper Pipes and Tubes Worldwide

Copper Pipes and Tubes Regional Market Outlook:

Key Companies in Copper Pipes and Tubes Market:

Key Developments in Copper Pipes and Tubes Market:

| 1. Lawton Tubes Announces Dollar 20 Million UK Expansion: In July 2025, Lawton Tubes, a leading copper tubing manufacturer, unveiled plans to construct a new Dollar 20 million facility adjacent to its Coventry headquarters. The project will include a modern two-story building—spanning approximately 10,000 m² of warehouse space along with 1,600 m² of office and welfare facilities—and is designed with sustainability in mind by integrating solar panels on the office rooftop. This strategic expansion enhances manufacturing, storage, and operational capabilities to support rising copper tube demand. |

| 2. Adani Enters Copper Tubes Venture with MetTube: In July 2025, Adani Enterprises finalized a strategic alliance with MetTube, agreeing to exchange 50% ownership stakes in their copper tube businesses (KCTL and MetTube’s Indian arm), creating a jointly governed enterprise. The venture will manufacture copper tubes essential for HVAC, renewable energy systems, and smart construction projects, boosting local production capabilities and reducing dependence on imports. |

Copper Pipes and Tubes Market Attributes:

| ATTRIBUTE | DETAILS |

| Market Value, 2024 | $US 30.1 Billion |

| Forecasted Market Value, 2035 | $US 49.2 Billion |

| CAGR (2025-2035) | 3.1% |

| Analysis Period | 2020-2035 |

| Historic Period | 2020-2023 |

| Base Year | 2019 |

| Forecast Period | 2025-2035 |

| Volume Unit | Tons |

| Value Unit | $US billion |

| Market Segmentation | By Product Type

By Grade

By Size

By Application

By End-User Industry

By Region

|

| Companies Profiles |

|

| Customization Request | Available upon request |

1. Introduction

1.1. Report Scope

1.2. Market Segmentations and Definitions

1.3. Geographical Coverage

2. Executive Summary

2.1. Key Facts and Figures

2.2. Trends Impacting the Market

2.3. DatasticsR Growth Opportunity Matrix

3. Market Overview

3.1. Global Copper Pipes and Tubes Market Analysis and Forecast, 2020-2035

3.1.1. Global Copper Pipes and Tubes Market Size (Tons)

3.1.2. Global Copper Pipes and Tubes Market Size ($US Bn)

3.2. Supply-side and Demand-side Trends

3.3. Technology Roadmap and Developments

3.4. Market Dynamics

3.4.1. Drivers

3.4.2. Restraints

3.4.3. Opportunities

3.5. Porter’s Five Forces Analysis

3.6. PESTL Analysis

3.7. Industry SWOT Analysis

3.8. Regulatory Landscape

3.9. Value Chain Analysis

3.9.1. List of Raw Materials Suppliers

3.9.2. List of Manufacturers

3.9.3. List of Dealers/Distributors

3.9.4. List of Potential Customers

3.10. Impact of Current Geopolitical Scenario on the Market

4. Technical Analysis

4.1. Product Specification Analysis

4.2. Details of Manufacturing Process

4.3. Technology Adoption and Emerging Technologies

4.4. R&D Trends and Patents Landscape

4.5. Cost Structure and Profitability Analysis

5. Global Production Output Analysis (Tons), by Region, 2019

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Import-export Analysis Volume (Tons) and Value ($US Bn), by Key Country, 2020-2024

7. Price Trend Analysis and Forecasting ($US/Ton), 2020-2035

7.1. Price Trend Analysis and Forecasting, by Product Type

7.2. Price Trend Analysis and Forecasting, by Region

8. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

9. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

10. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

11. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

12. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

13. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Region, 2020-2035

14. North America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

15. North America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

16. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

17. North America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

18. North America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

19. U.S. Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

20. U.S. Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

21. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

22. U.S. Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

23. U.S. Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

24. Canada Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

25. Canada Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

26. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

27. Canada Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

28. Canada Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

29. Europe Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

30. Europe Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

31. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

32. Europe Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

33. Europe Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

34. Germany Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

35. Germany Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

36. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

37. Germany Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

38. Germany Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

39. U.K. Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

40. U.K. Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

41. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

42. U.K. Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

43. U.K. Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

44. France Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

45. France Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

46. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

47. France Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

48. France Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

49. Italy Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

50. Italy Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

51. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

52. Italy Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

53. Italy Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

54. Spain Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

55. Spain Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

56. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

57. Spain Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

58. Spain Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

59. Russia & CIS Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

60. Russia & CIS Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

61. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

62. Russia & CIS Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

63. Russia & CIS Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

64. Rest of Europe Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

65. Rest of Europe Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

66. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

67. Rest of Europe Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

68. Rest of Europe Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

69. Asia Pacific Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

70. Asia Pacific Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

71. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

72. Asia Pacific Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

73. Asia Pacific Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

74. China Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

75. China Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

76. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

77. China Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

78. China Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

79. India Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

80. India Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

81. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

82. India Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

83. India Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

84. Japan Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

85. Japan Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

86. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

87. Japan Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

88. Japan Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

89. South Korea Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

90. South Korea Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

91. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

92. South Korea Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

93. South Korea Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

94. Taiwan Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

95. Taiwan Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

96. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

97. Taiwan Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

98. Taiwan Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

99. Australia Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

100. Australia Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

101. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

102. Australia Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

103. Australia Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

104. ASEAN Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

105. ASEAN Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

106. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

107. ASEAN Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

108. ASEAN Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

109. Rest of Asia Pacific Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

110. Rest of Asia Pacific Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

111. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

112. Rest of Asia Pacific Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

113. Rest of Asia Pacific Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

114. Latin America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

115. Latin America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

116. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

117. Latin America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

118. Latin America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

119. Mexico Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

120. Mexico Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

121. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

122. Mexico Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

123. Mexico Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

124. Brazil Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

125. Brazil Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

126. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

127. Brazil Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

128. Brazil Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

129. Argentina Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

130. Argentina Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

131. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

132. Argentina Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

133. Argentina Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

134. Rest of Latin America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

135. Rest of Latin America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

136. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

137. Rest of Latin America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

138. Rest of Latin America Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

139. Middle East and Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

140. Middle East and Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

141. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

142. Middle East and Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

143. Middle East and Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

144. Saudi Arabia Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

145. Saudi Arabia Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

146. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

147. Saudi Arabia Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

148. Saudi Arabia Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

149. UAE Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

150. UAE Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

151. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

152. UAE Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

153. UAE Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

154. South Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

155. South Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

156. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

157. South Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

158. South Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

159. Rest of Middle East and Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Product Type, 2020-2035

160. Rest of Middle East and Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Grade, 2020-2035

161. Global Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Size, 2020-2035

162. Rest of Middle East and Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by Application, 2020-2035

163. Rest of Middle East and Africa Copper Pipes and Tubes Market Analysis and Forecasting (Tons) ($US Bn), by End-use, 2020-2035

164. Competition Landscape

164.1. Market Share Analysis (%), by Company, 2024

164.2. Competitive Benchmarking

164.3. Company Profiles

164.3.1. Furukawa Electric Co., Ltd.

164.3.1.1. Company Overview

164.3.1.2. Product Portfolio

164.3.1.3. Financials

164.3.1.4. Geographical Footprint

164.3.1.5. SWOT Analysis

164.3.1.6. Recent Developments and Strategies

164.3.2. Global Brass and Copper Holdings, Inc.

164.3.2.1. Company Overview

164.3.2.2. Product Portfolio

164.3.2.3. Financials

164.3.2.4. Geographical Footprint

164.3.2.5. SWOT Analysis

164.3.2.6. Recent Developments and Strategies

164.3.3. ElvalHalcor

164.3.3.1. Company Overview

164.3.3.2. Product Portfolio

164.3.3.3. Financials

164.3.3.4. Geographical Footprint

164.3.3.5. SWOT Analysis

164.3.3.6. Recent Developments and Strategies

164.3.4. Mueller Industries

164.3.4.1. Company Overview

164.3.4.2. Product Portfolio

164.3.4.3. Financials

164.3.4.4. Geographical Footprint

164.3.4.5. SWOT Analysis

164.3.4.6. Recent Developments and Strategies

164.3.5. Aurubis AG

164.3.5.1. Company Overview

164.3.5.2. Product Portfolio

164.3.5.3. Financials

164.3.5.4. Geographical Footprint

164.3.5.5. SWOT Analysis

164.3.5.6. Recent Developments and Strategies

164.3.6. Cerro Flow Products LLC

164.3.6.1. Company Overview

164.3.6.2. Product Portfolio

164.3.6.3. Financials

164.3.6.4. Geographical Footprint

164.3.6.5. SWOT Analysis

164.3.6.6. Recent Developments and Strategies

164.3.7. Fabrika bakarnih cevi A.D. Majdanpek

164.3.7.1. Company Overview

164.3.7.2. Product Portfolio

164.3.7.3. Financials

164.3.7.4. Geographical Footprint

164.3.7.5. SWOT Analysis

164.3.7.6. Recent Developments and Strategies

164.3.8. Foshan Huahong Copper Tube Co., Ltd

164.3.8.1. Company Overview

164.3.8.2. Product Portfolio

164.3.8.3. Financials

164.3.8.4. Geographical Footprint

164.3.8.5. SWOT Analysis

164.3.8.6. Recent Developments and Strategies

164.3.9. Cambridge-Lee Industries LLC

164.3.9.1. Company Overview

164.3.9.2. Product Portfolio

164.3.9.3. Financials

164.3.9.4. Geographical Footprint

164.3.9.5. SWOT Analysis

164.3.9.6. Recent Developments and Strategies

164.3.10. H & H Tube

164.3.10.1. Company Overview

164.3.10.2. Product Portfolio

164.3.10.3. Financials

164.3.10.4. Geographical Footprint

164.3.10.5. SWOT Analysis

164.3.10.6. Recent Developments and Strategies

164.3.11. Zhejiang Hailiang Co., Ltd.

164.3.11.1. Company Overview

164.3.11.2. Product Portfolio

164.3.11.3. Financials

164.3.11.4. Geographical Footprint

164.3.11.5. SWOT Analysis

164.3.11.6. Recent Developments and Strategies

164.3.12. Kobelco & Materials Copper Tube Co. Ltd.

164.3.12.1. Company Overview

164.3.12.2. Product Portfolio

164.3.12.3. Financials

164.3.12.4. Geographical Footprint

164.3.12.5. SWOT Analysis

164.3.12.6. Recent Developments and Strategies

164.3.13. MM Kembla

164.3.13.1. Company Overview

164.3.13.2. Product Portfolio

164.3.13.3. Financials

164.3.13.4. Geographical Footprint

164.3.13.5. SWOT Analysis

164.3.13.6. Recent Developments and Strategies

164.3.14. Brassco Tube Industries

164.3.14.1. Company Overview

164.3.14.2. Product Portfolio

164.3.14.3. Financials

164.3.14.4. Geographical Footprint

164.3.14.5. SWOT Analysis

164.3.14.6. Recent Developments and Strategies

164.3.15. Wieland Group

164.3.15.1. Company Overview

164.3.15.2. Product Portfolio

164.3.15.3. Financials

164.3.15.4. Geographical Footprint

164.3.15.5. SWOT Analysis

164.3.15.6. Recent Developments and Strategies

164.3.16. Others

165. Appendix