Objective of the Study

- Understand addressable market and growth rate %

- Most attractive targetable segments for the period 2020-2035

- Adoption of elemental phosphorous and different derivatives in various applications such as food, pharmaceuticals, plastics, pesticides, etc.

- List of potential customers that can be targeted

- Identify the key manufacturers and their product offering for different applications

Overview

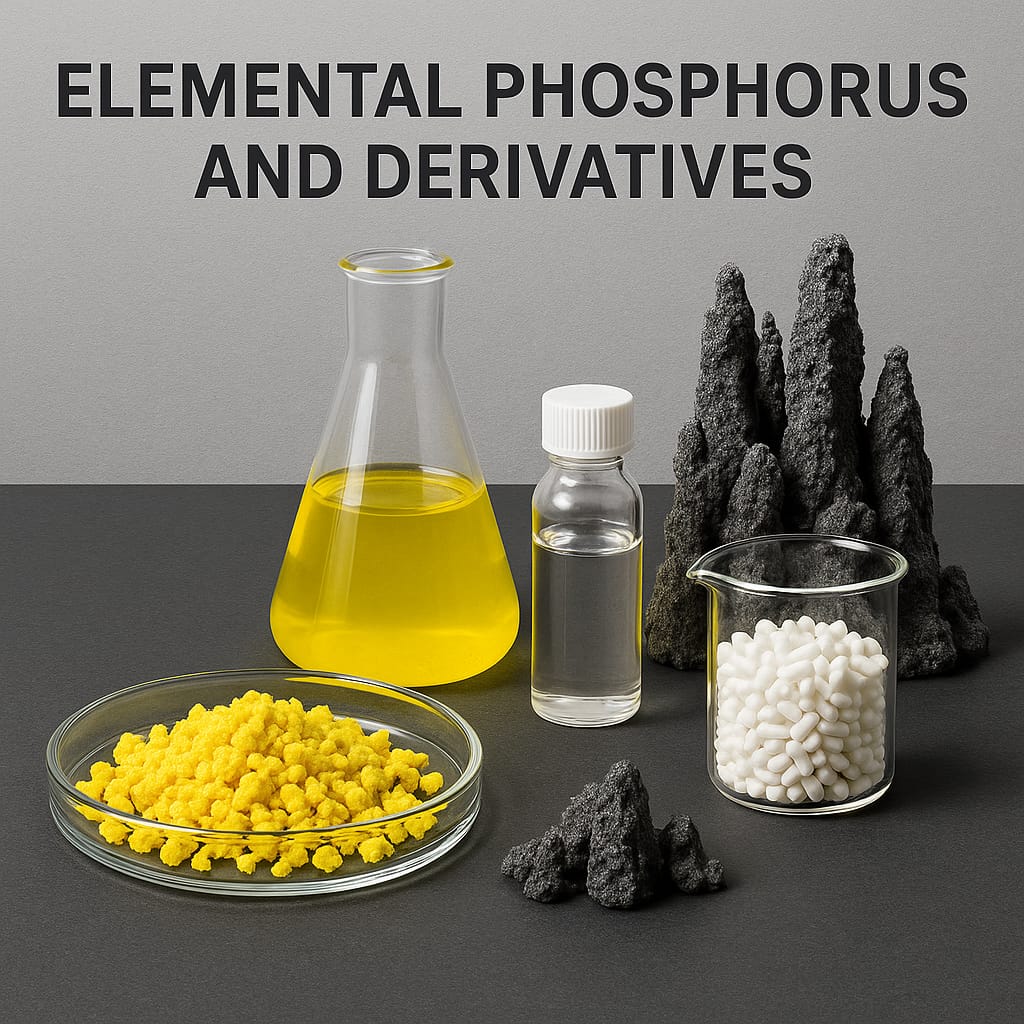

Elemental phosphorus (P₄), primarily in the form of white phosphorus, is a reactive, tetrahedral molecule used as a precursor in chemical synthesis. Its key derivatives include phosphoric acid, phosphorus pentachloride, phosphorus trichloride, phosphates, and phosphine, widely applied in fertilizers, flame retardants, batteries, and industrial chemicals. This report analyzes usages of elemental phosphorous and it’s derivatives these application areas.

The adoption of derivatives is significantly higher than it’s elemental form as derivatives are safer, more stable, and easily adaptable for agriculture, batteries, and industrial use. Elemental phosphorous accounted for ~95% of the overall demand whereas, elemental phosphorous accounted for less than 5% of the overall market.

Expanding agrochemical and fertilizer usage and rising consumption of flame retardant and chemicals to drive the demand and growth of elemental phosphorous and derivatives; and at the same time stringent environmental and regulatory norms related to phosphorous production along with cost-intensive production process are hindering the market growth.

This report discusses about various leading manufacturers of elemental phosphorous and derivatives such as Bayer AG, UPL, ICL Group Ltd., Syensqo, Innophos, Lanxess, Aditya Birla, and Italmatch Chemicals SpA in terms of their product offerings, market shares, new innovations and futuristic strategies

Primary Snippet

The supply of elemental phosphorous is very limited and concentrated in 4 countries the U.S., China, Vietnam, and Kazakhstan. These four countries are supplying the elemental phosphorous and have the control over it’s price as rest of world is dependent on these four countries to further produce derivatives.

Asia Pacific is the largest producer and consumer of both elemental phosphorous as well as it’s derivatives. This region will be dominating in the next upcoming time with resource availability, rising agricultural demand for phosphate based fertilizers, and booming battery and EV sector

Sales Manager – ICL Group Ltd.

Results

$US 3.6 Billion

(Market size in 2024)

Pesticide

(Most attractive application that contributes ~50% of the overall market)

7.6% Growth in Li-ion Batteries

(Li-ion battery is the fastest growing application within elemental phosphorous derivatives; 7.6% during the period 2025-2035)

Leading Players

(Bayer AG, UPL, ICL Group Ltd., Syensqo, Innophos, Lanxess, Aditya Birla, and Italmatch Chemicals SpA, are the leading players that constitute more than 67% of the market share)

Conclusion:

Derivatives have dominated the elemental phosphorous and derivatives market with pesticides application accounting for 50% of the overall market and 53% among the derivatives; however, the li-ion batteries application segment is expected to grow at a highest CAGR in the next 8-10 years. This is primarily due to its high energy density, cost-effectiveness, suitability for EVs and energy storage systems, and advancements addressing conductivity and stability challenges.

In terms of regions, Asia Pacific accounted for the largest share of 47.6% in 2024 and is expected to witness the highest CAGR during 2025-2035 due to strong fertilizer consumption, and government support for clean energy, agrochemicals, and expanding semiconductor sector.

Our Approach

Supply Side Approach

- Identified the key manufacturers and mapped their products related to elemental phosphorous and derivatives

- Collected their overall and industry specific revenues from annual reports, investor presentations and other publications

- Estimation of overall market size (value) based on revenues of players and their market shares

- Estimated the ratio of elemental phosphorous and P4 derivatives from the product mapping done specifically for each of the applications and their respective revenue calculation

- Detailed price analysis (quotation from manufacturers, import-export database, etc.)

- Exhaustive primary interviews for data validation

Demand Side Approach

- Researched each of the derivatives to understand their incumbent properties

- Analyzed usage level of each of product type/derivatives in different applications/sub-applications

- Analyzed procurement quantity/value to understand their individual shares to the overall market

- Analyzed shares of various sub-applications within application areas based on the usage level and demand of elemental phosphorous and derivatives in those applications

- Detailed primary interviews for data validation